If you book using a travel credit card with insurance coverage, you can probably skip American's travel insurance.

Published Sep 15, 2023 9:01 a.m. PDT · 3 min read Written by Ramsey Qubein Ramsey Qubein

Conde Nast Traveler, Travel+Leisure, Forbes.com, CNBC.com, AFAR, Robb Report, Reader's Digest, BBC Worldwide, USA Today, Frommers.com, Fodors.com, Islands, Business Traveler, Fortune, Airways, Yahoo, Travel Age West, MSN.com, Bustle.com, AAA magazines

Ramsey is a freelance travel journalist covering business travel, loyalty programs and luxury travel. His work has appeared in Travel+Leisure, Condé Nast Traveler, Reader's Digest, AFAR, BBC Worldwide, USA Today, Frommers.com, Fodors.com, Business Traveler, Fortune, Airways, TravelAge West, MSN.com, Bustle.com and AAA magazines. As someone who flies more than 450,000 miles per year and has been to 173 countries, he is well-versed in the intricacies of credit cards and how to maximize the associated perks and services.

Assistant Assigning Editor Giselle M. Cancio

Assistant Assigning Editor | Travel rewards, budget travel, credit cards

Giselle M. Cancio is a former editor for the travel rewards team at NerdWallet. She has traveled to over 30 states and 20 countries, redeeming points and miles for almost a decade. She has over eight years of experience in journalism and content development across many topics.

She has juggled many roles in her career: writer, editor, social media manager, producer, on-camera host, videographer and photographer. She has been published in several media outlets and was selected to report from the 2016 Summer Olympics in Rio de Janeiro.

She frequents national parks and is on her way to checking all 30 Major League Baseball parks off her list. When she's not on a plane or planning her next trip, she's crafting, reading, playing board games, watching sports or trying new recipes.

She is based in Miami. Fact Checked

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Travel insurance can be one of the most confusing parts of booking a trip. Since many credit cards already include travel insurance, the question of whether to buy airline insurance can make sense.

Why would you pay twice for the same benefits? But, that’s the thing: Not every type of credit card covers the same travel insurance perks.

You’ll want to check if the card you use to book a flight covers a cancellation , lost baggage or an abrupt change to your travel plans — perhaps due to a medical emergency. Being prepared can save you a lot of money in the long run.

This is especially true if you cannot take a trip, which would mean forfeiting the money you spent on nonrefundable flights and hotels.

If you want maximum protection, consider your credit card insurance with an airline’s policy like from American Airlines travel insurance.

Understanding the American Airlines insurance policies can protect you on your next trip with the carrier.

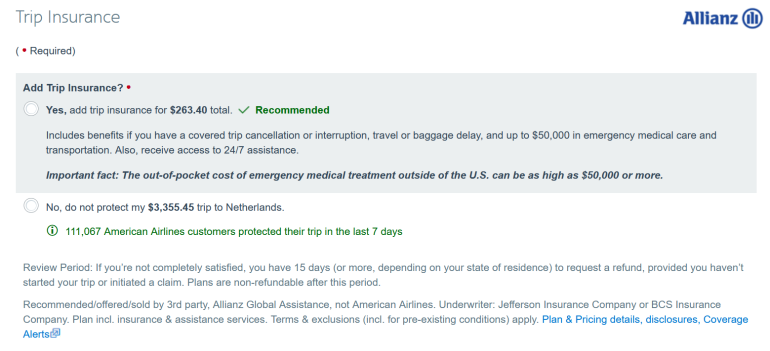

American has plans for international and domestic trips you book with the carrier, and the services are administered by Allianz Global Assistance . You’ll see the offer when completing a flight reservation on the website.

When you qualify, the policy can refund part of an itinerary or the entire purchase based on any travel costs or emergency medical expenses in case of a disruption or delay. The promotional offer you receive when booking a ticket is based on the cost of your flight. It is valid for that trip only, unlike annual or multi-trip plans that you would buy from Allianz directly.

Often, you won’t see the trip insurance policy on your American reservation, as it's sold by a third party. But keep a record of the policy information.

When you buy American Airlines travel insurance, you will be eligible for coverage for various travel issues like delayed or lost bags, medical expenses during the trip or if you have to cancel the trip altogether.

Some features of travel insurance can vary depending on where you live, so be sure to read the fine print.

This is what the flight insurance from American Airlines covers:

Trip cancellation and trip interruption costs. If you paid for any nonrefundable expenses and have to cancel or change your trip due to reasons like illness or injury, you’ll receive a refund for those costs. This can be especially valuable for bucket-list trips like cruise or safari vacations where you spend a lot of money. Each U.S. state sets a limit for the refund amount, so be sure to review those details.

Emergency medical transportation. If you need to be airlifted or driven a long distance to the nearest appropriate hospital or urgent care center, this would be covered by insurance. This can be pretty expensive in some remote locations, and insurance can cover the cost of a helicopter airlift if needed. The American travel insurance benefit for emergency medical transportation is as much as $50,000.

Emergency medical and dental protection. While at the hospital or urgent care facility, you may need immediate care. American Airlines trip insurance would cover up to $10,000 in medical and dental expenses for an eligible occurrence.

Travel delay. This is a valuable benefit, one covered by many credit cards. If you encounter a trip delay of at least six consecutive hours, this insurance will provide meal and accommodation reimbursements. The maximum coverage limits vary by U.S. state. Airlines have their own policies in these situations, and if traveling from the European Union or on an E.U.-based carrier to Europe, you may also be covered for additional compensation.

Lost or damaged baggage. If your baggage is lost, damaged or stolen, American Airlines travel insurance reimburses you up to $500 for your personal items.

Baggage delay. This protection covers the contents of your bag if your baggage was delayed for more than 24 hours. You’ll want to keep eligible receipts of your purchase to submit a reimbursement claim, typically up to $100 per person.

24-hour assistance. This policy would provide you with direct access to someone who can assist you with any travel-related emergencies.

Rental car collision and damage. You would be eligible for primary coverage without a deductible.Remember that airlines like American receive a percentage of the sale of travel insurance, so they are eager to promote it. But not all circumstances are covered. This means it is important to review the exclusions.

These are some of the situations that wouldn't be eligible for reimbursement or assistance.

Losses due to government restrictions, travel advisories or warnings (For example: If the U.S. government issues a warning not to travel somewhere).

Losses due to known, foreseeable and expected events (like a hurricane where advance warnings are available).